Contribution margins are often compared to gross profit margins, but they differ. Gross profit margin is the difference between your sales revenue and the cost of goods sold. Crucial to understanding contribution margin are fixed costs and variable costs.

Use of Contribution Margin Formula

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. One common misconception pertains to the difference between the CM and the gross margin (GM). These can fluctuate from time to time, such as the cost of electricity or certain supplies that depend on supply chain status.

Contents

With that all being said, it is quite obvious why it is worth learning the contribution margin formula. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Why You Can Trust Finance Strategists

However, it may be best to avoid using a contribution margin by itself, particularly if you want to evaluate the financial health of your entire operation. Instead, consider using contribution margin as an element in a comprehensive financial analysis. This is one reason economies of scale are so popular and effective; at a certain point, even expensive products can become profitable if you make and sell enough. You can also use contribution margin to tell you whether you have priced a product accurately relative to your profit goals. Fixed costs are one-time purchases for things like machinery, equipment or business real estate.

- The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources.

- If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all.

- On the other hand, variable costs are costs that depend on the amount of goods and services a business produces.

- Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs).

Contribution Margin: What it is and How to Calculate it

If the selling price per unit is more than the variable cost, it will be a profitable venture otherwise it will result in loss. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold. While contribution margins only count the variable costs, the gross profit margin includes all of the costs that a company incurs in order to make sales. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits.

Unit Contribution Margin

The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs.

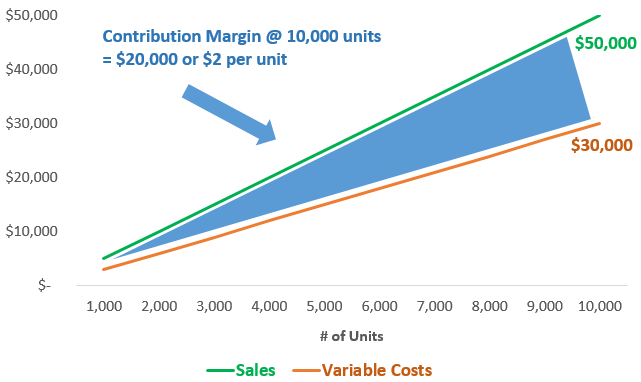

So, we deduct the total variable expenses from the net sales while calculating the contribution. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. Let’s now apply these behaviors to the the components of an operations management aggregate plan concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. In our example, the sales revenue from one shirt is \(\$15\) and the variable cost of one shirt is \(\$10\), so the individual contribution margin is \(\$5\).

In the same case, if you sell 100 units of the product, then contributing margin on total revenue is $6,000 ($10,000-$4,000). This is because fee-for-service hospitals have a positive contribution margin for almost all elective cases mostly due to a large percentage of OR costs being fixed. For USA hospitals not on a fixed annual budget, contribution margin per OR hour averages one to two thousand USD per OR hour. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better. The higher the number, the better a company is at covering its overhead costs with money on hand.

Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. Bankrate.com is an independent, advertising-supported publisher and comparison service.

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. While contribution margin is an important business metric, how you calculate variable costs influences the number.

In such cases, the price of the product should be adjusted for the offering to be economically viable. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Management should also use different variations of the CM formula to analyze departments and product lines on a trending basis like the following. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.