Knowing how to calculate the contribution margin is an invaluable skill for managers, as using it allows for the easy computation of break-evens and target income sales. This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses. Let’s say we have a company that produces 100,000 units of a product, sells them at $12 per unit, and has a variable costs of $8 per unit.

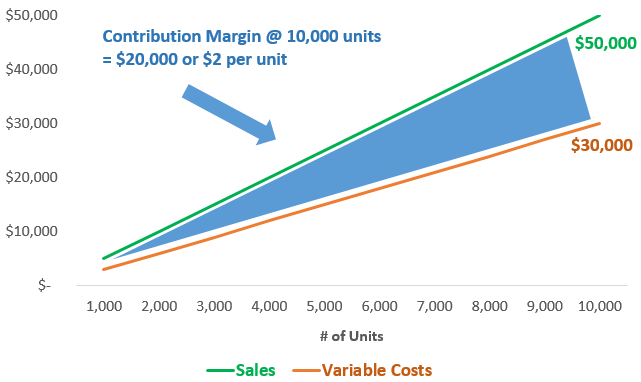

- Furthermore, a contribution margin tells you how much extra revenue you make by creating additional units after reaching your break-even point.

- Fixed costs are costs that are incurred independent of how much is sold or produced.

- Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued.

- Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold.

The Evolution of Cost-Volume-Profit Relationships

Watch this video from Investopedia reviewing the concept of contribution margin to learn more. Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit. Fixed costs usually stay the same no matter how many units you create or sell. The fixed costs for a contribution margin equation become a smaller percentage of each unit’s cost as you make or sell more of those units. Consider its name — the contribution margin is how much the sale of a particular product or service contributes to your company’s overall profitability. It’s how valuable the sale of a specific product or product line is.

How we make money

The larger the contribution margin, the better, as it indicates more money to apply to fixed costs. What’s leftover after variable and fixed costs are covered is the profit. If the margin is negative, the company is losing money producing the product. Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs. Profit is any money left over after all variable and fixed costs have been settled.

Contribution Margin vs. Gross Profit Margin

On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales. A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business.

Other financial metrics related to the Contribution Margin Ratio include the gross margin ratio, operating margin ratio, and net profit margin ratio. These ratios provide insight into the overall profitability of a business from different perspectives. To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit. In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential.

The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs. For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage. Use contribution margin alongside gross profit margin, your balance sheet, and other financial metrics and analyses. This is the only real way to determine whether your company is profitable in the short and long term and if you need to make widespread changes to your profit models.

The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s secure cash box cash boxes and security boxes break-even analysis. A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit. The contribution margin further tells you how to separate total fixed cost and profit elements or components from product sales.

The contribution margin and the gross profit margin are both analysis tools used to help businesses increase profits, but they measure different aspects of a business. The former looks at how one product contributes to the company’s profits and the difference between the sales price and variable costs, while the latter looks at overall business profits. The contribution margin excludes fixed costs, whereas the profit margin includes fixed costs. To calculate the gross profit, subtract the cost of goods sold (COGS) from revenue. To understand how profitable a business is, many leaders look at profit margin, which measures the total amount by which revenue from sales exceeds costs.

The more customers she serves, the more food and beverages she must buy. These costs would be included when calculating the contribution margin. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs.

To run a company successfully, you need to know everything about your business, including its financials. One of the most critical financial metrics to grasp is the contribution margin, which can help you determine how much money you’ll make by selling specific products or services. Management uses the contribution margin in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line. Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues.