Allocating budgets to various opportunities while making sure that they offer the highest ROI can be quite challenging for stakeholders. Also, build these purchases into your long-term budget so you don’t experience any surprises. Ensure you have the necessary funds to cover the upfront cost of any major acquisition. Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more. Therefore, the calculation of Capital Expenditure incurred during 2018 is $16,000. Let’s see some simple to advanced examples to understand the calculation of Capital Expenditure.

- Since CapEx tends to depreciate over time, careful financial analysis and ROI evaluation are extremely important.

- Capital expenditures are characteristically very expensive, especially for companies in industries such as manufacturing, telecom, utilities, and oil exploration.

- Let’s consider an example where a company had beginning net fixed assets of $500,000, ending net fixed assets of $700,000, and depreciation expense of $100,000 during the designated period.

- If you have access to a company’s cash flow statement, then no calculation is necessary and you can simply see the capital expenditures that were made in the investing cash flow section.

Importance of Capex Calculation

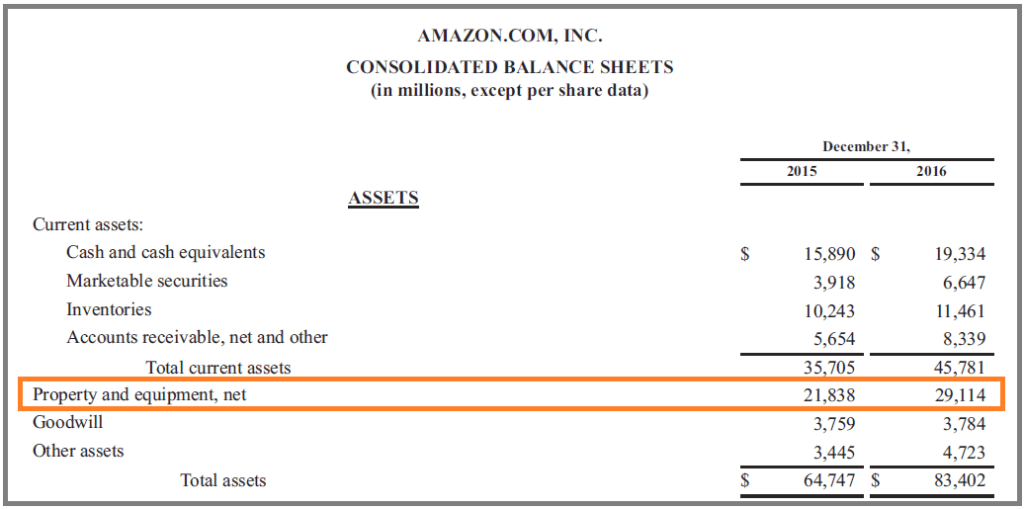

It provides insights into the company’s investment strategy, future growth prospects, and financial health. Capital Expenditure is the total amount that a Company spends to buy & upgrade its fixed assets like PP&E (Property, how to find capex Plant, Equipment), technology, & vehicles, etc. The formula of Capex is the addition of net change in Property Plant and Equipment (PP&E) value over a given period to the depreciation expense for the same year.

How does a capital expenditure appear on the three financial statements?

It involves evaluating the expected return on investment (ROI) and the financial impact of the capital project. CapEx purchases are differentiated by their role in furthering the company’s goals and expansion efforts. Capex refers to funds used by a company to acquire or upgrade physical assets such as property, buildings, or equipment. A negative capital expenditure indicates a reduction in long-term assets, which can occur when a company sells or disposes of existing assets.

How are capital expenditures reported?

Operating expenses are only purchases that affect short-term assets, such as rent on office space, raw materials for production, office supplies like pens and printer paper, and employee paychecks. OpEx are paid for directly from the company’s revenue, while CapEx are often financed with debt or equity. In fiscal year 2022, ABC Company purchased $10,000 of new equipment for its manufacturing plant. ABC also upgraded five of its employees’ existing computers for $5,000 and paid a repairman $2,000 to fix a broken down machine. Of these items, the new equipment and the upgraded computers are CapEx and the machine repair is OpEx.

High Initial Costs

Measuring and estimating the costs and benefits of capital expenditures can be a complex and challenging task. A high ratio reveals that a company has a lesser need to utilize debt or equity funding since it has enough cash to cover possible capital expenditures. These are fixed, tangible assets utilized by businesses to generate revenue and profit. Improvements are capital expenses incurred to increase the value or prolong the useful life of long-term assets. The accounting process of identifying, measuring, and estimating the costs relating to capital expenditures may be quite complicated. There is a wide range of depreciation methods that can be used (straight line, declining balance, etc.) based on the preference of the management team.

These are capital expenses made to acquire long-term assets that will be used in business operations. Meanwhile, costs that are not related to generating future revenues, such as rent, advertising, or salaries, are considered operating expenses. At the start of your capital expenditure project, you need to decide whether you will purchase the capital asset with debt or set aside existing funds for the purchase. Saving money for the purchase usually implies that you will have to wait for a while before getting the asset you need. Capital investment decisions are a driver of the direction of the organization. The long-term strategic goals, as well as the budgeting process of a company, need to be in place before authorization of capital expenditures.

On the other hand, what if you need to expand your current factory or purchase a brand new building for your offices? For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. It is important to have separate budgets for capital expenditures and operational expenses.

For instance, for a manufacturing unit, inclusion of a conveyor belt could be a significant cost. However, the increased pace of production and packing can lead to higher productivity and ultimately more sales and profits. Since CapEx and expenses can seem fairly similar, it can often be confusing when you actually capitalize or expense them. The decision ultimately comes down to how long you expect to receive a benefit from your expenditure. Here is everything that you need to know for how to calculate CapEx, including the formula and some examples.